Ai News

How AI is Transforming The Bank Sector in USA?

AI was introduced in banking in the early stages, before this banks used simple automation services for basic tasks like transaction processing and record keeping. As time passed, technology became more advanced, Banks started using the latest AI tools for their operations and services.

In the last decades, AI tools become an integral part of banking services and operations. The large amount of data generated by banks provides a perfect opportunity for AI to analyze and insight efficient solutions.

Key drivers for AI adoption

AI helps in better customer service, Modern customers expect quick, personalized, and easy-to-use bank services. AI provides all these recommendations with its advanced and latest tools, by using chatbots for instant help and providing quick service according to customer demand.

AI is a multi-model software, which can handle many tasks at a time. So it helps banks in cost saving. Many tasks require many human workers, AI can do such tasks alone like data entry, record keeping, and many more customer services. This saves banks money and allows human workers to focus on more complex tasks.

AI Powered Fraud Detection

Real-time Monitoring:

AI systems can easily monitor unusual activities that might indicate fraud. It can spot and detect any transactions as they happen. AI learns human behavior. If something out of the ordinary happens, they quickly spot it. For instance sudden large withdrawal or an unusual transaction. They detect illegal things and the system flags them. They do real-time monitoring and recognize frauds and unnecessary alerts.

Many algorithms in AI systems detect and send alerts for unusual activities. They save banks and customers from great loss.

Enhanced security Measures:

AI can work with security measures, like biometric authentication (fingerprints or Facial recognition), to add extra protection. If AI detects unusual activity, it can trigger additional verification steps to ensure the person making the transaction belongs to the account holder.

AI systems can process and analyze large amounts of data much faster and quickly than humans. This ability allows AI to detect and analyze complex patterns and transactions that might be fraudulent, which humans might not be able to measure.

Artificial intelligence systems use machine learning models that are trained on historical and large amounts of data of fraudulent and illegal transactions. These models help them to detect and identify fraudulent activities based on past and historical patterns.

Read Also: How Intelligence Sharing Can Help Keep Major Worldwide Sporting Events on Track

AI in Risk Management

AI is revolutionizing risk management in banking systems by making it more precise, efficient, and proactive. Here’s how AI systems banks in managing risks:

Predictive Risk Analysis:

AI uses advanced algorithms to analyze extensive data from multiple sources, such as transaction histories, trends, and record keeping. By recognizing patterns and trends, AI can detect potential risks before they happen. For instance, if an AI system detects signs of an impending economic downturn, banks can adjust their potential losses.

Enhanced Credit Scoring:

Traditional credit scoring depends on limited data. Like credit history and income. AI systems, however, can handle a broader range of factors, including spending habits, social media activity, and smartphone usage patterns. This comprehensive analysis gives a more accurate and authentic picture of a customer’s credit, aiding banks in making better lending decisions, reducing the risk of defaults, and enhancing credit scoring.

Early Warning Systems:

AI-driven early warning systems continuously monitor and detect various risk indicators and flag potential issues. Before they become significant. For instance, if a company shows signs of financial trouble, an AI system can alert the bank, enabling them to take preventive measures and early action. This proactive approach of AI allows banks to address risks before they escalate and help transform the bank sector depending on it.

Benefits Of AI Use in The Bank Sector in USA

Improving Decision-Making:

AI provides banks with valuable results derived from data analysis, enhancing their decision-making processes. By understanding modern market trends and customer behavior, banks can make informed decisions about product development, marketing strategies, customer demands and investment, and loan opportunities.

In banking, AI helps by analyzing a lot of data more quickly than humans. It looks at things like how customer use their accounts, and credit cards, trends in the economy, and what competitors are doing.

With this information, banks can make decisions like where to invest money, what new products to offer, and how to make services better for their customers and employees. AI makes these decisions quickly and more accurately than humans can alone, helping banks stay ahead and make choices that are more likely to succeed and achieve goals.

Future Prospects:

The prospects of AI in USA banking look promising, with continuous advancements and the latest in technology expected to bring even more accurate insights. Emerge technologies like blockchain and the Internet of Things will likely be integrated with Artificial intelligence sera, offering new opportunities for banks and customers to enhance bank services and operations.

However, banks must also address ethical, legal, and authentic concerns, such as data privacy, security, and algorithmic bias, to ensure the sustainable adoption of AI in banking.

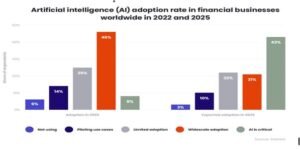

Global Growth:

AI in banking is not just growing in the USA but across the world. Banks in many countries are adopting AI systems to improve their services, enhance the security and privacy of data, and streamline operations. This global adoption of AI means that more people around the world can benefit from advanced and latest banking technologies.

AI helps and guides banks in different countries to offer better customer service with their algorithms and modern tools, make smarter decisions, and protect against fraud more effectively. As AI continues to develop, its impact on banking will likely grow quickly, leading to more innovative solutions, insights, and improved financial services worldwide or globally.

Read More: Furry AI Art Generator: A Complete Guide for Beginners

Conclusion

AI is transforming the banking sector in the USA by enhancing customer service, adorable operations, improving risk management, detecting fraud transactions, ensuring regulatory compliance, and providing personalized financial services to banks and customers. As AI continues to evolve, it will bring even more opportunities for banks to improve their services and operations with the use of the latest tools and technologies of AI. By embracing AI systems, banks can stay ahead and competitive, protect and secure their assets and data, and ensure long-term stability in an increasingly digital era. The adoption of AI systems and modern technology in banking is not just a trend but necessary for future growth and success.

Follow Dallee for more AI updates and News.